VIP AP Automation

Accounts Payable Procurement Software

Modern P2P Software for Accounts Payable to Help Your AP Office Thrive

Your AP office deals with a lot. Between juggling massive to-do lists and managing ever-increasing expectations, it's easy to feel overwhelmed when searching for the best procure-to-pay (P2P) software. VIP Accounts Payable (AP) Payment Automation software is an easy-to-use payment tool designed to help municipalities provide fast and secure payments with better vendor experiences.

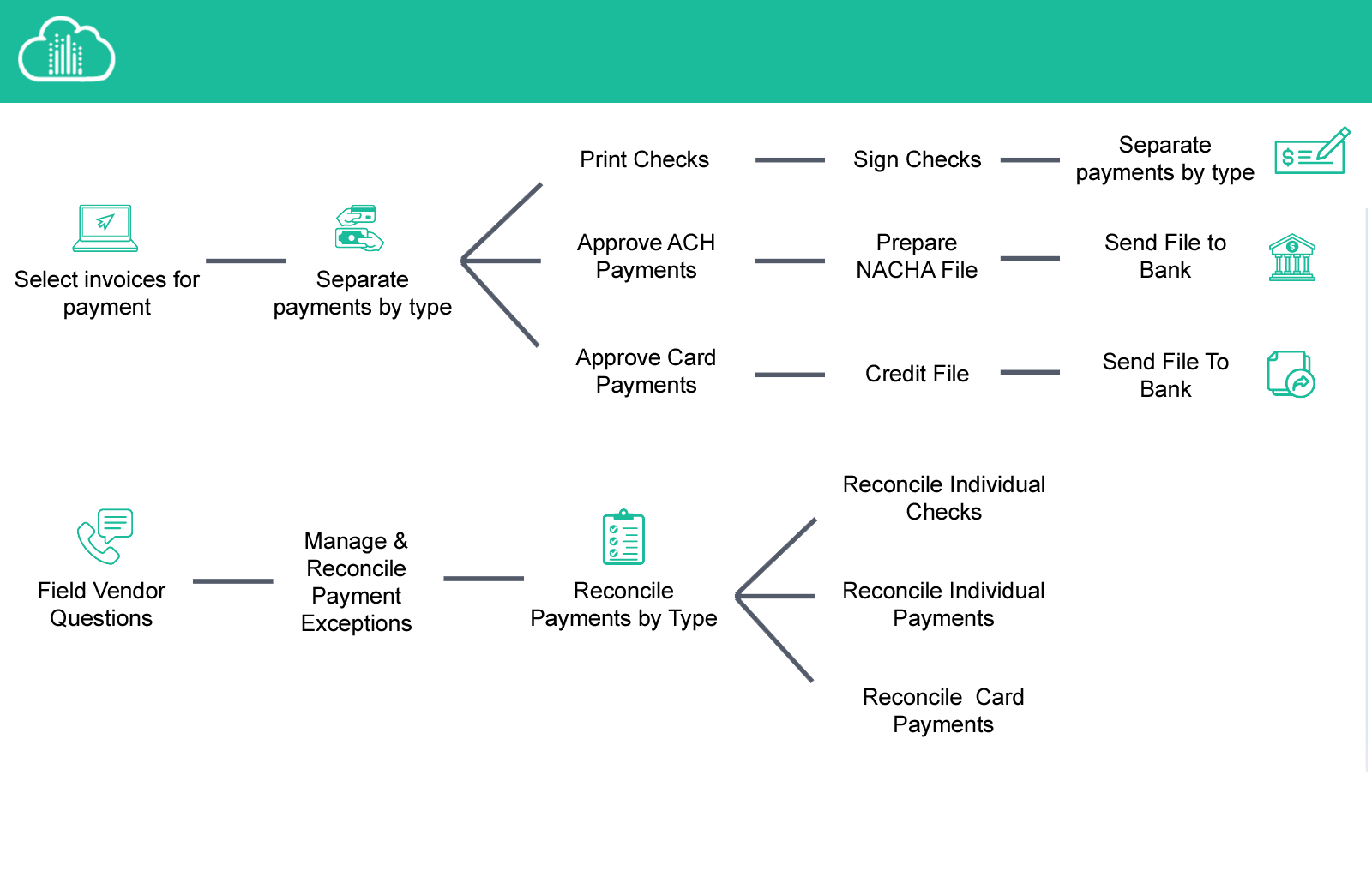

Your Process Today

Most organizations today pay their vendors by processing hard-to-track and expensive physical checks. There's a better way to automate your entire vendor payment process with accounts payable automation software solutions.

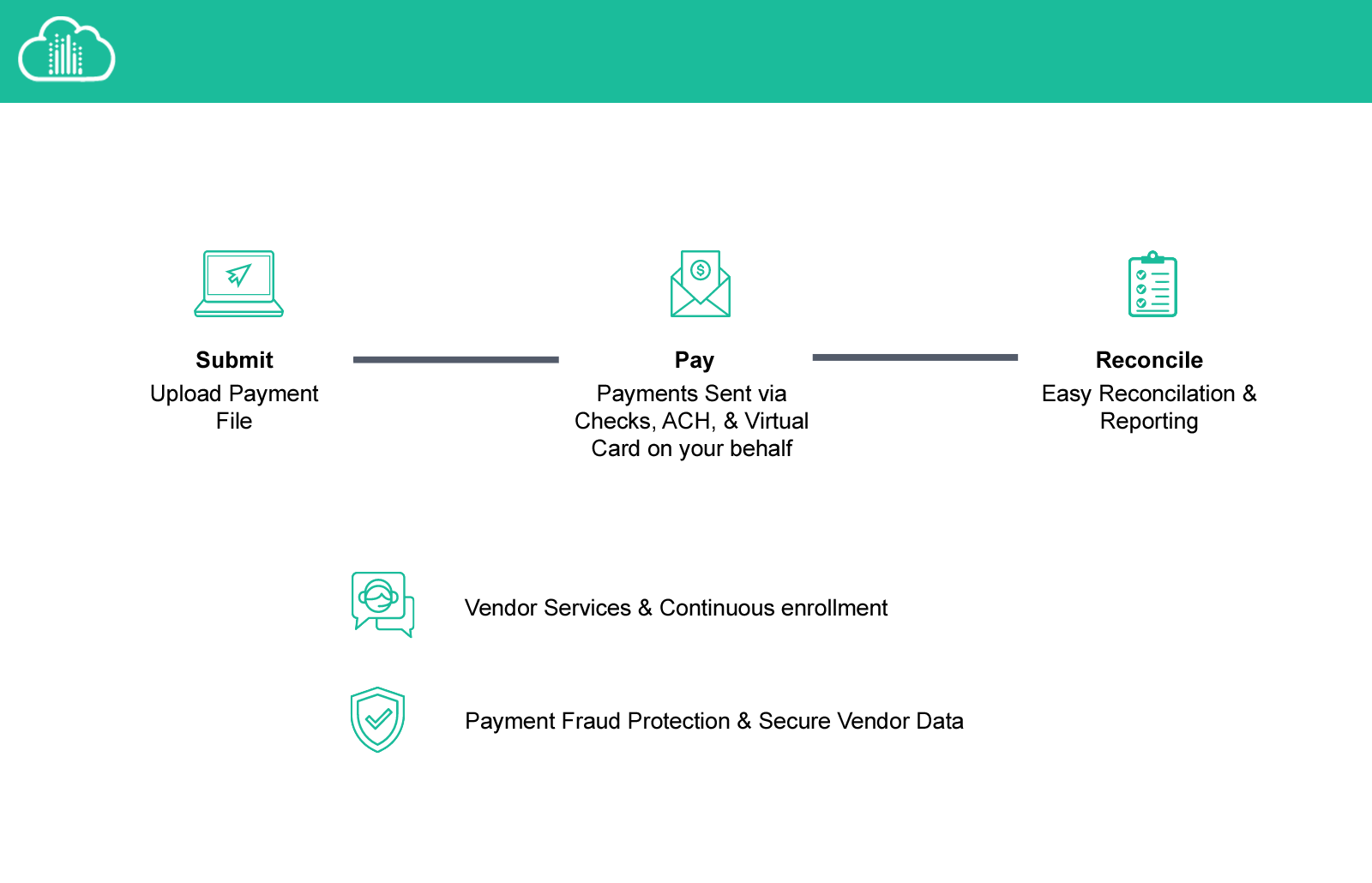

Your New AP Procure-to-Pay Process

Your process goes from complicated to streamlined. Just select the invoices ready to be paid and send out for processing. The payments are sent on your behalf with reconciliation details provided once the payment goes through. It's that easy.

Your Payment Automation Journey

Imagine what your AP office will look like after it's automated? No more slow and repetitive processes. No more costly physical checks and questions from vendors wondering when they will be paid.

The journey doesn't happen overnight, but the benefits at the end make it all worth it with accounts payable automation.

.png)

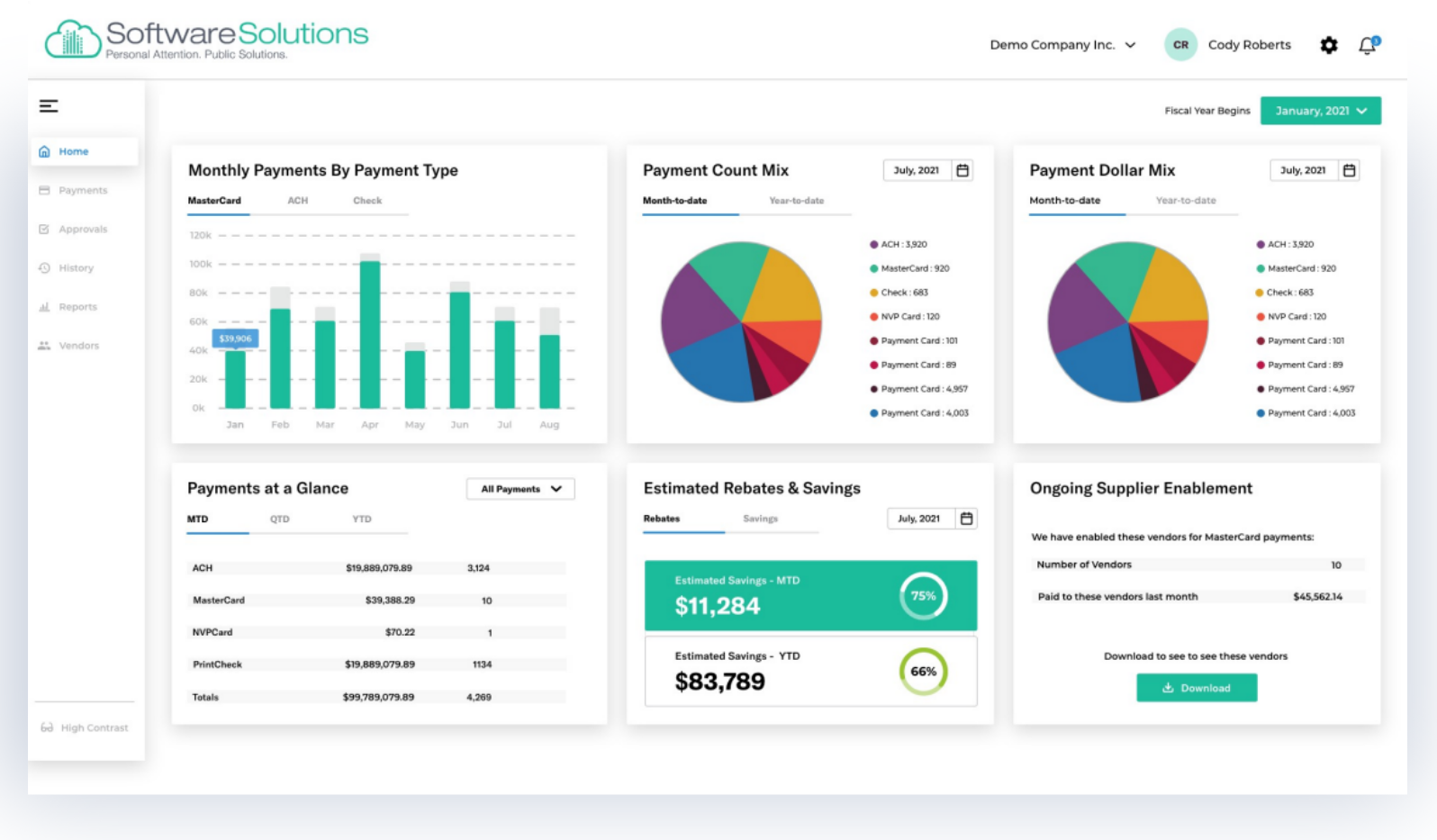

Your AP Payment Portal

The AP VIP Payment Portal provides you with the tools and data you need to make better decisions. Log in to see important insights on how your AP office is operating in real-time. View monthly payment breakdowns by type and ongoing vendor engagement to better understand your accounts payable automation potential.

How It Helps Your Organization

Simplified Process - There is a single workflow for all AP payments, reducing errors and double-entry.

Cost Savings - Operationally, it costs an average of $4 - $20 to process a single physical check. Physical costs are drastically reduced by moving from check payments to P2P electronic payments.

Reduced Fraud Risk - Your organization does not have to store the suppliers' banking data.

Better Vendor Relationships - Vendors will have various payment options with detailed remittances and access to their own portal for support and visibility.

Frequently Asked Questions about AP Automation

-

Q: I want to send separate checks for my invoices? Is it the same process as before?

A: No. AP Automated payments will not respect the “Requires Separate Payments” option on the remit-to vendor. Instead, you must manually separate payments that will be issued as separate checks into separate payment batches. These payments may be in a batch with other AP Automated payments but cannot be from the same vendor or they will be combined automatically into one check/payment.

-

Q: Will the Doing Business As (DBA) line print on AP Automated checks/remittances?

A: No. At this time, DBA information is not part of the payment file sent to our AP VIP partner. Adjust your Vendor Business Name and/or First/Last Name fields accordingly if this presents an issue for the vendor.

-

Q: Who should be contacted first when there is an issue with a payment?

A: Contacting our AP VIP partner first for submitted or completed payments may save you time overall. If you are having difficulties with the payment batch or posting a payment batch, SSI Support is available to assist.

-

Q: When posting my accounts payable automation payment batch, do I choose Post or Post to Print Tray?

A: Either will work. VIP AP Automation payments will not go to a print tray. Clicking either option will immediately send payment information for processing.

-

Q: I have a new vendor that I want to pay using AP Automation. What do I do?

A: Create your vendor and/or remit-to vendor per usual. Bring in your finalized invoice into the payment batch along with other VIP AP Automation payments. Before posting, it is recommended to verify the pay to name and payment address are as expected. Then post your payment batch. The new vendor’s information will be sent along with the payment for matching to our AP VIP partner's vendor database. If it matches an existing vendor, their preferred payment method (i.e., – check, ACH, vCard) will be used. Otherwise, if there is no match, we will initiate a payment via check and begin the outreach process to identify the vendor’s preferred payment method for future payments.

-

Q: How are lost checks, wrong addresses, or wrong vendor situations handled?

A: The entity and the vendor should always work directly with our AP VIP partner's Vendor Support team.

Our AP VIP partner manages all vendor support. They ask the vendor to contact them if they have lost a check (or their dog ate it). Our goal is to help the vendor move to a digital payment if possible. Otherwise, our AP VIP partner will stop payment and reissue the check. If it is a wrong address, the vendor can contact support and we will reissue. Our AP VIP partner also asks that the vendor contact the entity to make sure the entity’s records in VIP are updated (our partner takes the address from the payment file generated and sent from VIP).

-

Q: What compliance and procedures do you have in place to ensure security? SOC, PCI, etc. Can compliance docs be provided to me if requested during an audit?

A: Our AP VIP partner is SOC 1,2 & 3 Compliant. If an entity wants a copy, we can send it upon request. We will need a name, title, address, email address, and phone number along with an NDA.

-

Q: Are the checks that you send out entity checks or checks with you as the payee name?

A: Checks are sent out with the entity name on them. Note: the routing/account numbers are from the FBO account.

-

Q: How do check signatures work? Would the entity’s finance director have the signature on the check?

A: Checks are drawn on the FBO account and not the entity so there is nothing to sign. The entity can elect to use the electronic payment workflow (Batch or Payment) to record approval of the payment batch or individual payments. Once the payments are approved, they are finalized through accounts payable automation.

-

Q: Where are the checks printed and sent from?

A: Currently, all checks are mailed first class from Portland, OR. We are in the process of adding a second check processor on the East Coast (no set date on when processing from there will begin). Several studies were done showing that regardless of where checks were mailed from, it takes about the same amount of time to be received.

-

Q: When are payments sent?

A: All payments go out the next business day if the payment file is received before 5 pm PST.

-

Q: Do you charge the vendors who choose Mastercard a fee?

A: We do NOT charge any fees for Mastercard payments. The fees are charged between the customer and their merchant acquirer.

-

Q: If you reissue a check with a new check number, will the new check number be pulled into VIP when clicking on the Get Payment Status button?

A: We use a new check number, but both checks would be tied to the original payment reference number. AP VIP will not get the updated check number, but the AP Gateway would show both checks and a history of what happened.

-

Q: What is the record retention on the AP Gateway site? How long is payment history/workflow history retained in AP Gateway? [In relation to public records laws.]

A: 7 Years

-

Q: Do I issue 1099’s to vendors who were paid with virtual credit cards?

A: No 1099’s would be issued for vendors paid by virtual cards as the merchant acquiring entity would be responsible for issuing a 1099-K to these vendors. Virtual Card payment amounts would not be eligible for vendor Misc or NEC reporting.

-

Q: Do you use the Scheduled Pay Date in the payment file?

A: We will use the Scheduled Pay Date and hold the payment until the scheduled date, if one is entered and the payment is approved. This process is managed through accounts payable automation software to ensure accurate timing and efficiency.

Watch a Webinar

We have several free webinars you can watch on-demand on industry topics like cybersecurity, AP Automation, the Fair Labor Standards Act, artificial intelligence, budgeting, and more.

Check out more

of our products & solutions

Learn more about our Visual Intelligence Portfolio (VIP) software suite at your own pace.

Perfect for: those who want to do some "window shopping" before contacting us. (Take all the time you need).

Ready to start a conversation?

Fill out this form and someone will reach out to chat and answer your questions.

.png?width=625&height=625&name=Satisfied%20Financial%20Software%20Customer%20(1).png)